What is Risk Analysis?

Risk can be viewed as either the probability of something going wrong or the probability of turning into reality. Risk analysis is essentially the anticipation and management of risks that may result from an event or action, i.e., the anticipation of risks that a business or venture might face. It is the process of analyzing possible issues that can negatively affect a business initiative or project. Similarly, risk management is the identification, assessment, and control of risks that might affect an organization’s earnings or capital.

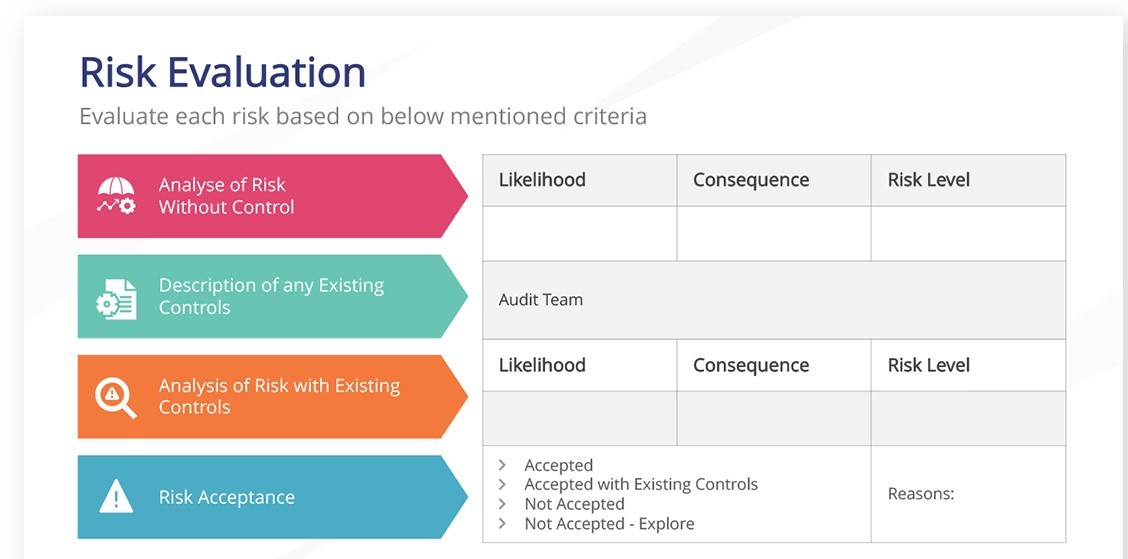

When performing a risk analysis, one must identify possible threats and then assess the likelihood of those threats materializing. To assess risks, you will need to dig into detailed project plans, financial information, forecasts, etc.

How to use Risk Analysis?

Risk analysis requires identifying and estimating risks to back decision making to protect the organization from possible financial, reputational, procedural, technical, structural, natural, and political risks.

Banks, insurance firms & capital markets are now facing extraordinary challenges related to profitability, complexity as well as new regulations in an uncertain economic environment, an environment we refer to as one of “permanent volatility.” This practice can help financial services firms focus upon the three key challenges of increasing profitability, reducing complexity and managing regulations.

We guarantee our client multi layered and integrated solutions which seeks to reduce risks to As Low as Reasonably Practicable (ALARP) with much consideration of business operational continuity. The security evaluation methodology used is anchored on five pillars which are Security programs, Human measures, Architectural or environmental design measures, Security Procedures and Equipment or security hardware. We use best practices in corporate security risk analysis tool and shall always endeavor to offer cost effective security solution.